CUSTOMER SELF SERVICE JOURNEY

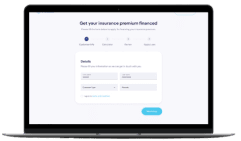

Bespoke insurance premium financing solution helps customers carry out the process right from the comfort of their homes. This can be enabled by an easy API integration at the customer check-out page.

INTERMEDIARY ASSISTED JOURNEY

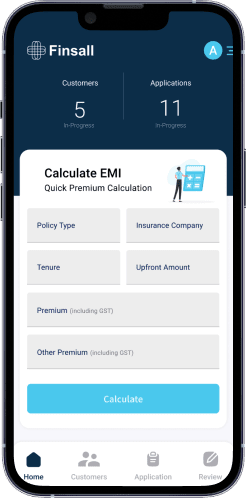

An assisted journey can be started today itself. Intermediaries can use our App or Web portal to assist customers in their premium financing journey. Quote, customer tracking, application tracking, etc., can be done on the fly.

Customer’s Self journey

Aman, 40, has reached an ageing landmark and is looking to plan for his family’s well-being. He is looking for health insurance options for his family & selects a 10 L sum assured policy which costs Rs. 40,000.

Rs. 40,000 is too much for him to pay upfront as his monthly expenses & EMIs are already lined up.

Aman has already chosen the cover he wants for his family and the limits.

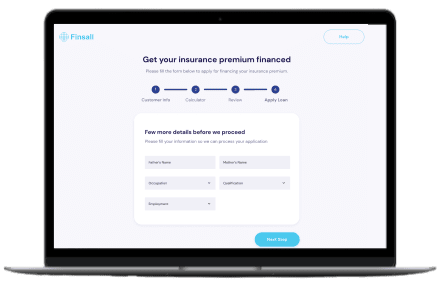

He is happy to discover Finsall on the check-out page as a premium financing option and starts the process.

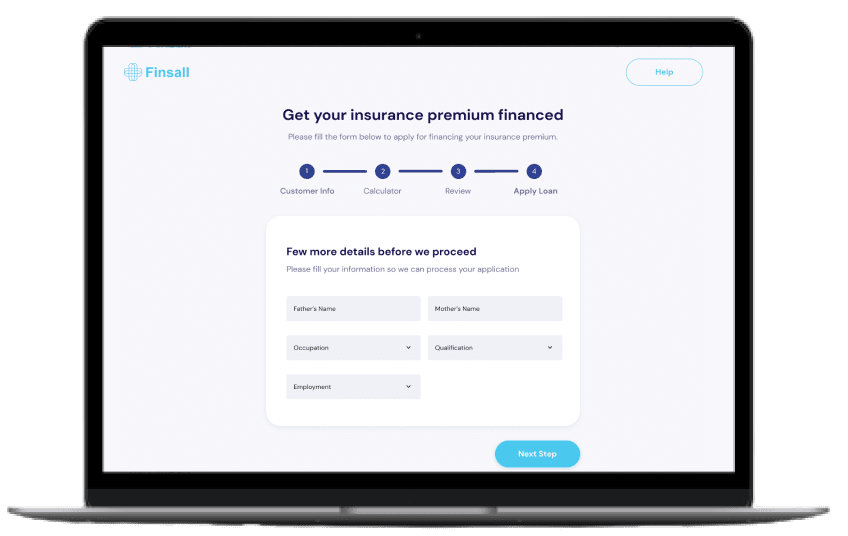

Aman is lead to Finsall’s page, where most of his data is pre-filled. This starts his paperless process.

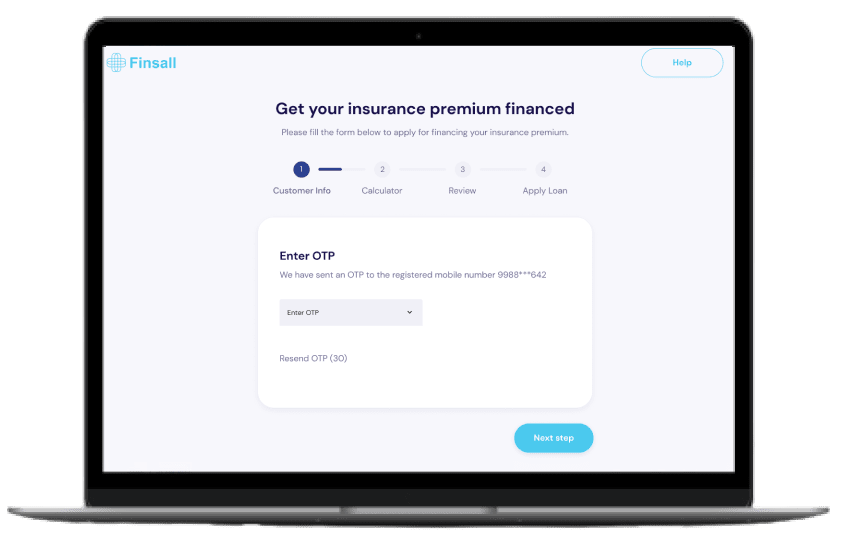

Aman has to then provide his consent for verification and credit assessment. He enters the OTP and clicks next.

Once verification is completed, Aman is immediately told about his approval. He then confirms/updates his personal data for the application.

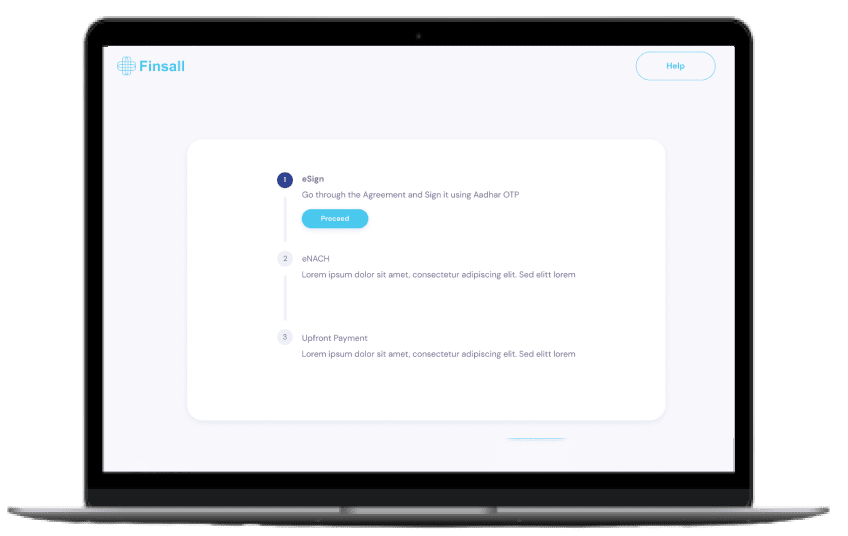

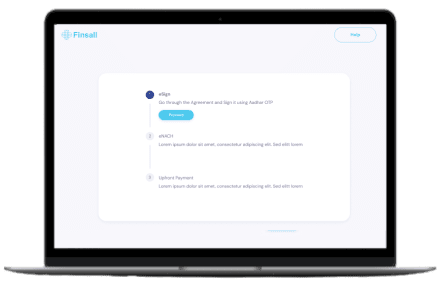

Aman is lead to a simple onboarding page, which has a step-by-step process. At this point, Aman finds his Aadhaar Card and completes the eKYC, eSign, and eNACH process.

The application is then checked by Finsall for quality assurance. Once it passes the quality checks, Aman completes the upfront payment, and the policy is issued instantly.

Finsall continues to help Aman with monthly EMI

reminders and

access points for any of his queries.

For more information

Please connect with our premium financing specialists

Intermediary Led Journey

Aman, 40, has reached an ageing landmark and is looking to plan for his family’s well-being. He is looking for health insurance options for his family & selects a 10 L sum assured policy which costs Rs. 40,000.

Rs. 40,000 is too much for him to pay upfront as his monthly expenses & EMIs are already lined up.

He reaches out to an intermediary. Intermediaries explains Aman the option of insurance financing offered by finsall.

After Aman’s approval, the intermediary calculates the upfront and EMI amount on the Finsall App or Web Portal.

Post approval, Aman’s details are updated with the relevant proposal form.

A verification OTP is sent to Aman to keep the process secure and compliant. Once completed, details are assessed, and approval is granted.

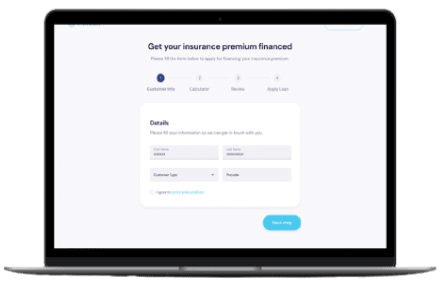

Once Aman is confident of the quote details, the intermediary fills in his basic information on the Finsall App or Web Portal.

Aman receives a link for completing the step-by-step process required for all compliances and KYC.

The application is then checked by Finsall for quality assurance. Once it passes the quality checks, Aman completes the upfront payment, and the policy is issued instantly.

Finsall continues to help Aman with monthly EMI

reminders and

access points for any of his queries.

For more information

Please connect with our premium financing specialists

Customer’s Self journey

Aman, 40, has reached an ageing landmark and is looking to plan for his family’s well-being. He is looking for health insurance options for his family & selects a 10 L sum assured policy which costs Rs. 40,000.

Rs. 40,000 is too much for him to pay upfront as his monthly expenses & EMIs are already lined up.

Aman has already chosen the cover he wants for his family and the limits.

He is happy to discover Finsall on the check-out page as a premium financing option and starts the process.

Aman is lead to Finsall’s page, where most of his data is pre-filled. This starts his paperless process..

Aman has to then provide his consent for verification and credit assessment. He enters the OTP and clicks next.

Once verification is completed, Aman is immediately told about his approval. He then confirms/updates his personal data for the application.

Aman is lead to a simple onboarding page, which has a step-by-step process. At this point, Aman finds his Aadhaar Card and completes the eKYC, eSign, and eNACH process.

The application is then checked by Finsall for quality assurance. Once it passes the quality checks, Aman completes the upfront payment, and the policy is issued instantly.

Finsall continues to help Aman with monthly EMI reminders and access points for any of his queries.

Intermediary Led Journey

Aman, 40, has reached an ageing landmark and is looking to plan for his family’s well-being. He is looking for health insurance options for his family & selects a 10 L sum assured policy which costs Rs. 40,000.

Rs. 40,000 is too much for him to pay upfront as his monthly expenses & EMIs are already lined up.

He reaches out to an intermediary. Intermediaries explains Aman the option of insurance financing offered by finsall.

After Aman’s approval, the intermediary calculates the upfront and EMI amount on the Finsall App or Web Portal.

Once Aman is confident of the quote details, the intermediary fills in his basic information on the Finsall App or Web Portal.

A verification OTP is sent to Aman to keep the process secure and compliant. Once completed, details are assessed, and approval is granted.

Post approval, Aman’s details are updated with the relevant proposal form.

Aman receives a link for completing the step-by-step process required for all compliances and KYC.

The application is then checked by Finsall for quality assurance. Once it passes the quality checks, Aman completes the upfront payment, and the policy is issued instantly.

Finsall continues to help Aman with monthly EMI reminders and access points for any of his queries.